The Fakey Pattern (Inside Bar False Break Out)

Fakey 形态 (内线 False 突破)

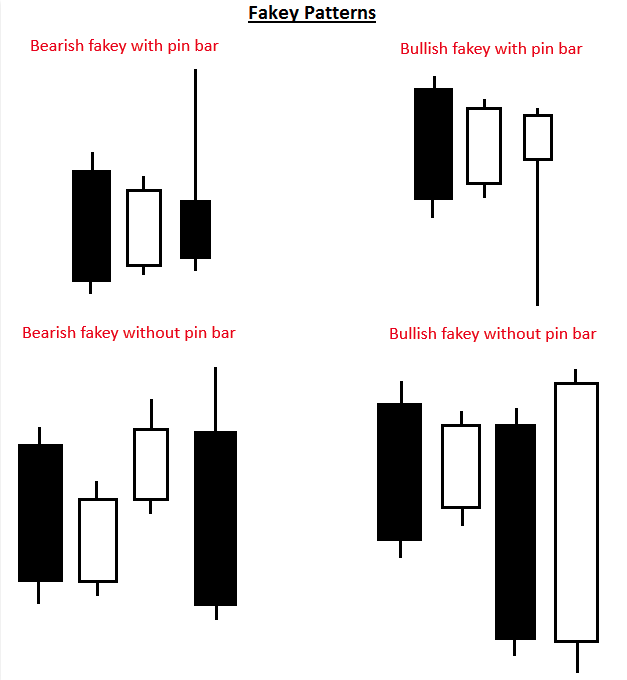

The Fakey pattern can be best be described as a “false-breakout from an inside bar pattern”. The Fakey pattern always starts with an inside bar pattern. When price initially breaks out from the inside bar pattern but then quickly reverses, creating a false-break, and closes back within the range of the mother bar or inside bar, we have a fakey pattern.

Fakey 模式最好被描述为 “从内线柱线形态中假突破”。Fakey 模式总是以内线 bar 模式开始。当价格最初从内线形态突破,但随后迅速反转,产生假突破,并收盘回到母柱线或内线柱线的范围内时,我们有一个假形态。

So, think of it like this: Inside Bar + False-Breakout = Fakey pattern.

所以,可以这样想:内线 + 假突破 = Fakey 形态。

A Fakey pattern can have a pin bar as the false-break bar or not. The false-break bar might also be a two-bar pattern where the first bar closes outside the inside bar / mother bar range and then the subsequent bar completes the false-break by closing back within the range of the mother bar and (or) inside bar.

Fakey 模式可以有 pin bar 作为 false-break bar,也可以不作为 false-break bar。假突破柱线也可能是一个双柱线形态,其中第一根柱线收盘价在内线/母柱线范围之外,然后后续柱线通过在母柱线和(或)内线范围内收盘来完成假突破。

Fakey’s are a very important and potent price action trading strategy because they can help us identify stop-hunting by the ‘big boys’ and provide us with a very good clue as to what price might do next. Learning how to trade the fakey pattern is something every price action trader should take seriously, it’s a critical weapon to have in your p.a. trading arsenal.

Fakey’s 是一种非常重要且有效的价格行为交易策略,因为它们可以帮助我们识别“大佬”的止损猎人,并为我们提供一个很好的线索,告诉我们价格下一步可能会做什么。学习如何交易虚假模式是每个价格行为交易者都应该认真对待的事情,它是您的 p.a. 交易武器库中的重要武器。

Let’s take a look at some examples of different types of Fakey patterns to clarify this price action strategy.

让我们看一下一些不同类型的 Fakey 模式的示例,以阐明这种价格行为策略。

Note, in the above diagram of different Fakey patterns, there’s always an inside bar setup first, followed by the false-breakout of the inside bar. Fakey’s can vary slightly from the examples you see above, but the four examples above represent the most common types of Fakey trading strategies that you will encounter on the charts.

请注意,在上面不同 Fakey 模式的图中,总是首先有一个内线设置,然后是内线的假突破。Fakey 与您在上面看到的示例略有不同,但上面的四个示例代表了您将在图表上遇到的最常见的 Fakey 交易策略类型。

How to trade with Fakey Patterns

如何使用 Fakey Patterns 进行交易

Fakey patterns can be traded in trending markets, range-bound markets or even against the trend form key chart levels. There are a lot of false-breakouts in the Forex market, so learning to trade with the Fakey pattern is very important since it can help you take advantage of and profit from these false breakouts, rather than falling victim to them as so many traders do.

Fakey 模式可以在趋势市场、区间波动市场甚至与关键图表水平的趋势相反进行交易。外汇市场上有很多假突破,因此学习使用 Fakey 模式进行交易非常重要,因为它可以帮助您利用这些假突破并从中获利,而不是像许多交易者那样成为它们的受害者。

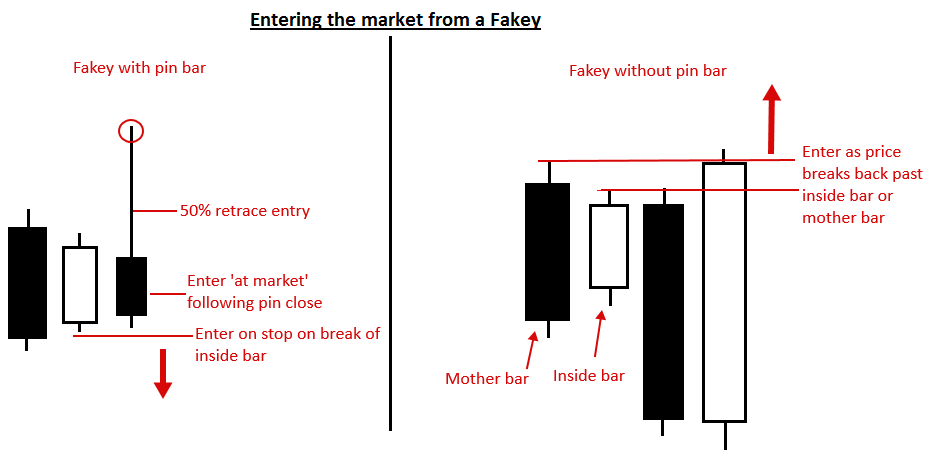

The most common entries for a Fakey signal include the following:

Fakey 信号最常见的条目包括:

- Enter as price breaks back past the inside bar or mother bar low or high, following the initial false-break. This can be an on-stop entry or an at market entry.

在价格突破内线或母线低点或高点时入场,在初始假突破之后。这可以是止损入场或市场入场。 - If the Fakey pattern has a pin bar you can use a pin bar trade entry

如果 Fakey 形态有 pin bar,您可以使用 pin bar 交易条目

Let’s take a look at several different examples of trading Fakey signals in various market conditions:

让我们看一下在各种市场条件下交易 Fakey 信号的几个不同示例:

Trading Fakey’s in a Trending Market

在趋势市场中交易 Fakey’s

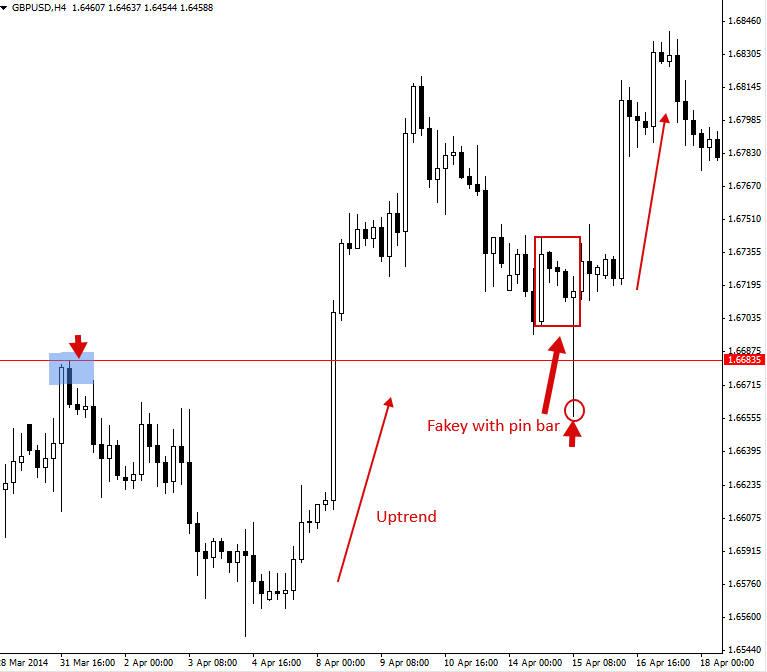

The chart below shows us a good example of a Fakey buy signal with a pin bar as the false-break bar, in a trending market. Note in this signal that there were actually three inside bars within the mother bar structure. This is relatively common, and sometimes you will even see four inside bars within a mother bar before the false-break or ‘Fakey’ bar occurs.

下图显示了在趋势市场中以 pin bar 作为假突破柱线的 Fakey 买入信号的一个很好的例子。请注意,在此信号中,母柱结构内实际上有三个内柱。这种情况相对常见,有时您甚至会在 false-break 或 ‘Fakey’ 柱线出现之前在母柱线中看到四个内柱线。

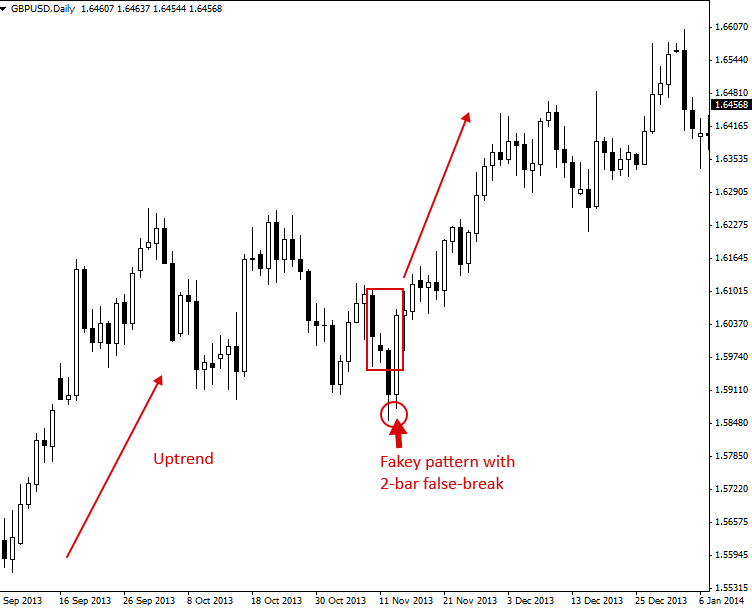

The next chart shows us another good example of trading a Fakey pattern in a trending market. There was a clear uptrend in place prior to the formation of this Fakey pattern. Note that this particular Fakey was one with a 2-bar false-break, meaning instead of one bar as the false-break, the false-break occurred over two consecutive bars. This is another common form of the Fakey signal to watch for as you analyze and trade the markets:

下一张图表向我们展示了在趋势市场中交易 Fakey 模式的另一个很好的例子。在这个 Fakey 形态形成之前,有一个明显的上升趋势。请注意,这个特定的 Fakey 是一个 2 柱的 false-break,这意味着 false-break 发生在两个连续的柱上,而不是一个柱作为 false-break。这是您在分析和交易市场时需要注意的另一种常见形式的 Fakey 信号:

Trading Fakey’s against the Trend from Key Chart Levels

从关键图表水平逆势交易 Fakey’s

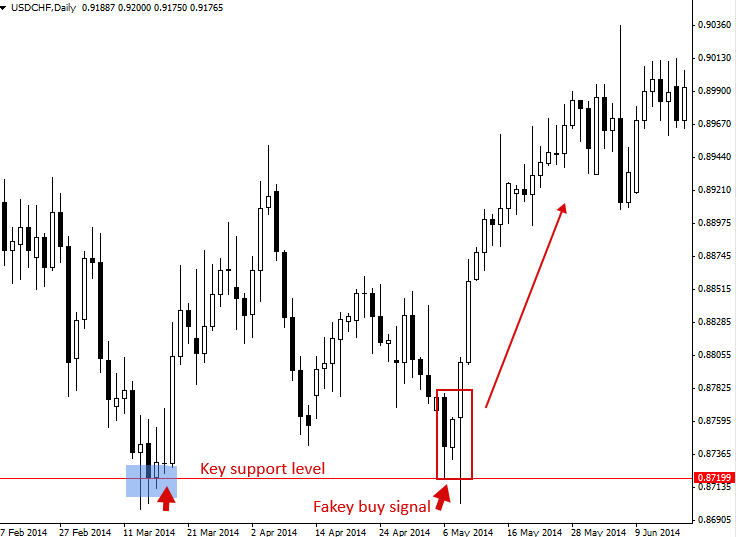

Next, we are looking at an example of a counter-trend Fakey. That means it’s a Fakey that implies price might move against the recent / near-term daily chart momentum / trend. In this case, it was a bullish Fakey buy signal that formed at a key support level, following a move lower. Since this Fakey signal was so nice and obvious (well-defined) and it had the confluence of the key support level under it, it was a counter-trend Fakey worth taking:

接下来,我们来看一个反趋势 Fakey 的例子。这意味着这是一个 Fakey,这意味着价格可能会与近期/近期日线图的动量/趋势相反。在这种情况下,在走低之后,在关键支撑位形成看涨的 Fakey 买入信号。由于这个 Fakey 信号非常好和明显(定义明确),并且它下方有关键支撑位的汇合点,因此它是一个值得采用的反趋势 Fakey:

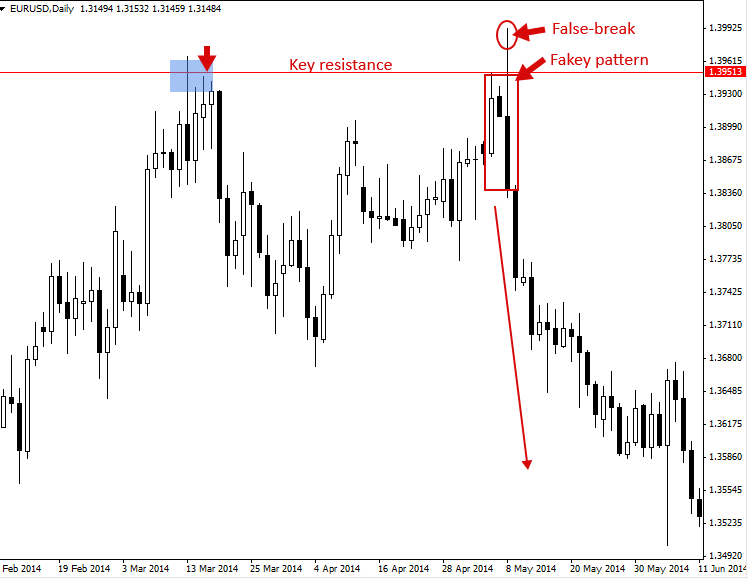

Here’s another example of a counter-trend Fakey pattern. This time it was a bearish Fakey sell signal from a key resistance level. Note the market was clearly pushing higher just prior to the formation of this Fakey. Then, when the Fakey formed, it also false-broke above a key resistance level in the market, adding extra ‘weight’ to the probability of a move lower. We can see the dramatic sell-off that followed this bearish Fakey:

这是另一个反趋势 Fakey 模式的例子。这一次是来自关键阻力位的看跌 Fakey 卖出信号。请注意,就在 Fakey 形成之前,市场显然在走高。然后,当 Fakey 形成时,它也假突破了市场的关键阻力位,为走低的可能性增加了额外的“权重”。我们可以看到这个看跌的 Fakey 之后的戏剧性抛售:

Tips on Trading the Fakey Pattern:

交易 Fakey 模式的提示:

- The above Fakey examples do not include ‘every’ permutation of Fakey you will encounter, rather they are some of the more common ones. Just remember that if you have an inside bar pattern, followed by a false-breakout of that inside bar pattern, you probably have a Fakey pattern.

上述 Fakey 示例不包括您将遇到的 Fakey 的“每个”排列,而是一些更常见的排列。请记住,如果您有一个内线柱线形态,然后是该内线柱线形态的假突破,则您可能有一个 Fakey 形态。 - The above point, does not mean that you should trade ‘every’ pattern that has the Fakey requirements discussed above. Whether or not you should take a particular Fakey depends on not only its formation, but also where it forms in the market, i.e., whether or not it has confluence and ‘makes sense’ within the underlying market picture / dynamics. As you gain training and education, experience and screen time price action trading, you’ll develop a better understanding of which Fakey’s (or other price action patterns) are worth trading and which are worth passing on.

以上一点并不意味着您应该交易具有上述 Fakey 要求的“每个”模式。您是否应该选择特定的 Fakey 不仅取决于它的形成,还取决于它在市场中的形成位置,即它是否在潜在的市场图景/动态中汇合并“有意义”。随着您获得培训和教育、经验和屏幕时间价格行为交易,您将更好地了解哪些 Fakey(或其他价格行为模式)值得交易,哪些值得传递。 - When beginning, stick to Fakey signals on the daily charts, as the daily chart signals will carry an overall higher degree of accuracy / reliability than lower time frame charts. Eventually, as you gain experience and confidence, you can work in 4 hour and 1 hour time frame Fakey’s.

开始时,请坚持日线图上的 Fakey 信号,因为日线图信号总体上比较低的时间框架图表具有更高的准确性/可靠性。最终,随着您获得经验和信心,您可以在 4 小时和 1 小时的时间范围内工作 Fakey’s