False Breakout Patterns 假突破模式

False-breakouts are exactly what they sound like: a breakout that failed to continue beyond a level, resulting in a ‘false’ breakout of that level. False breakout patterns are one of the most important price action trading patterns to learn, because a false-break is often a very strong clue that price might be changing direction or that a trend might be resuming soon. A false-break of a level can be thought of as a ‘deception’ by the market, because it looks like price will breakout but then it quickly reverses, deceiving all those who took the ‘bait’ of the breakout. It’s often the case that amateurs will enter what looks like an ‘obvious’ breakout and then the professional’s will push the market back the other way

假突破正是它们听起来的样子:未能持续超过某个水平的突破,导致该水平的“假”突破。假突破模式是需要学习的最重要的价格行为交易模式之一,因为假突破通常是价格可能正在改变方向或趋势可能很快恢复的非常有力的线索。一个水平的假突破可以被市场认为是“欺骗”,因为看起来价格会突破,但随后它会迅速反转,欺骗了所有上了突破“诱饵”的人。通常情况下,业余爱好者会进入看起来“明显”的突破,然后专业人士会将市场推向相反的方向

As a price action trader, you want to learn how to use false breakouts to your advantage, rather than falling victim to them.

作为价格行为交易者,您想学习如何利用虚假突破来发挥自己的优势,而不是成为它们的受害者。

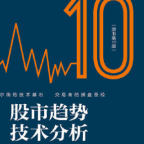

Here are two clear examples of false breakouts above and below key levels. Note that false breakouts can take different forms. Sometimes a false break will occur with a pin bar pattern or a fakey pattern as the false break, and sometime not:

以下是关键水平上方和下方的假突破的两个明显示例。请注意,假突破可以采用不同的形式。有时,pin bar 模式或 fakey 模式会发生假中断作为假中断,有时则不会:

A false breakout is essentially a ‘contrarian’ move in the market that ‘flushes’ out those traders who may have entered on emotion, rather than logic and forward thinking.

虚假突破本质上是市场上的“逆向”走势,它“淘汰”了那些可能凭情绪而不是逻辑和前瞻性思维进入的交易者。

Generally speaking, a false-break is happens because amateur traders or those with ‘weak hands’ in the market will tend to enter the market only when it ‘feels safe’ to do so. This means, they tend to enter when a market is already quite extended in one direction (and it’s about ready to retrace) or they try to ‘predict’ a breakout from a key support or resistance level too early. Professional traders watch for these missteps by the amateurs, and the end result is a very good entry for them with a tight stop loss and huge risk reward potential.

一般来说,假突破的发生是因为业余交易者或那些在市场上“手弱”的人往往只有在“感觉安全”的情况下才会进入市场。这意味着,他们倾向于在市场已经向一个方向延伸(并且即将准备回撤)时入场,或者他们试图过早地“预测”从关键支撑位或阻力位突破。专业交易员会注意业余爱好者的这些失误,最终结果对他们来说是一个非常好的入场点,具有严格的止损和巨大的风险回报潜力。

It takes discipline and a bit of ‘gut feel’ to know when a false-break is likely to occur, and you can never really know ‘for sure’ until after one has formed. The important thing, is to know what they look like and how to trade them, which we will discuss next…

需要纪律和一点 “直觉 ”才能知道什么时候可能会发生假中断,而且在假中断形成之前,你永远无法真正 “确定 ”知道。重要的是了解它们的外观以及如何交易它们,我们接下来将讨论……

How to trade false breakout patterns

如何交易虚假突破形态

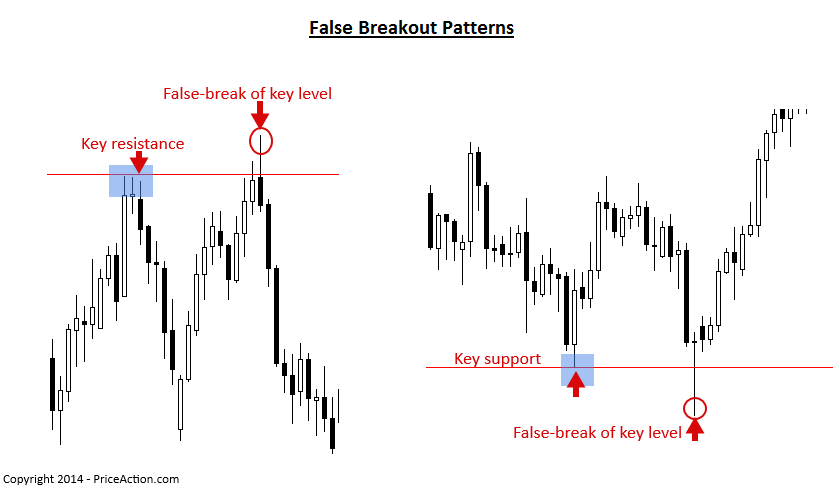

False breaks occur in all market conditions; trending, consolidating, counter-trend, but perhaps the best way to trade them is in-line with a dominant daily chart trend, like we see in the chart below.

假突破在所有市场条件下都会发生;趋势、盘整、逆趋势,但也许最好的交易方式是与占主导地位的日线图趋势保持一致,就像我们在下图中看到的那样。

Note, in the chart below, we had a clear downtrend in place and multiple false breakouts to the upside within that trend. When you see a false breakout that is against a dominant trend like this, it’s usually a very good signal that the trend is ready to resume. Amateur traders love to try and pick the bottom in a downtrend or the top in an uptrend, and this can cause false breakouts against the trend like we see below. On each of these false-breaks in the chart below, it was likely that amateur traders thought the downtrend was over and so they started buying, once this buying started the professionals came back in and took advantage of the temporary strength within the down-trending market and entered short from value, and then the downtrend resumed, flushing out all those amateur traders who tried picking the bottom.

请注意,在下图中,我们有一个明显的下降趋势,并在该趋势中多次出现虚假的上行突破。当您看到与这样的主导趋势相反的虚假突破时,这通常是一个非常好的信号,表明趋势已准备好恢复。业余交易者喜欢尝试在下降趋势中选择底部或在上升趋势中选择顶部,这可能会导致与趋势相反的错误突破,如下所示。在下图中的每一个这些错误突破中,业余交易者很可能认为下降趋势已经结束,因此他们开始买入,一旦这种购买开始,专业人士就会回来并利用下降趋势中的临时力量,从价值中进入空头,然后下降趋势恢复,淘汰了所有试图选择底部的业余交易者。

The chart below shows examples of false breakouts within a down-trending market. Note that each one led to a resumption of the trend…

下图显示了下跌趋势市场中的假突破示例。请注意,每一次都导致了趋势的恢复……

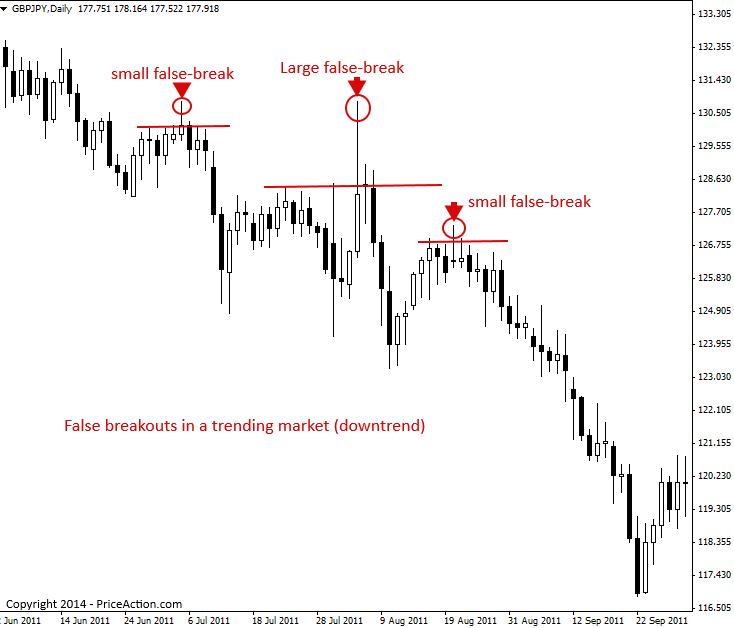

False-breaks are prevalent in trading ranges because traders often try to pick the breakout of the range but usually price stays range-bound for longer than most assume. Knowing that false-breaks are somewhat common when a market is struck in a trading range is a very valuable piece of information for a price action trader.

假突破在交易区间内很普遍,因为交易员经常试图选择突破区间,但通常价格在区间内波动的时间比大多数人假设的要长。知道当市场在交易区间内被触发时,假突破有些常见,这对价格行为交易者来说是一个非常有价值的信息。

Trading a range-bound market can be very lucrative as you can wait for price action signals at the support or resistance boundary of the range to trade back toward the other side of the range.

在区间震荡的市场进行交易可能非常有利可图,因为您可以等待区间支撑或阻力边界的价格行动信号,然后交易回区间的另一侧。

The best way to be sure you don’t get caught in a false-breakout from a trading range is to simply wait for price to close outside of the range for two days or more. If this happens, there’s a good chance the range is finished and price is then going to start trending again.

确保您不会陷入交易区间错误突破的最佳方法是等待价格收盘价超出区间两天或更长时间。如果发生这种情况,则很有可能该范围已完成,然后价格将再次开始趋势。

In the chart below, we can see how a price action trader can use a false breakout pin bar signal to trade a false breakout of a trading range. Note the false break pin bar at the trading range key resistance, and also note the two false-breaks at the trading range’s support. More experienced traders can also trade false breakouts that don’t contain a price action trigger like a pin bar. The two false-breaks of support in the chart below were both potential buy signals for a savvy price action trader…

在下图中,我们可以看到价格行为交易者如何使用虚假的突破 pin bar 信号来交易交易区间的虚假突破。请注意交易区间关键阻力位处的假突破 pin 条,并注意交易区间支撑处的两个假突破。更有经验的交易者也可以交易不包含价格行为触发器(如针杆)的虚假突破。下图中的两个虚假支撑突破都是精明的价格行为交易者的潜在买入信号……

False breakout patterns can sometimes signal the beginning of a new trend, and the end of the current one.

虚假的突破形态有时可能预示着新趋势的开始和当前趋势的结束。

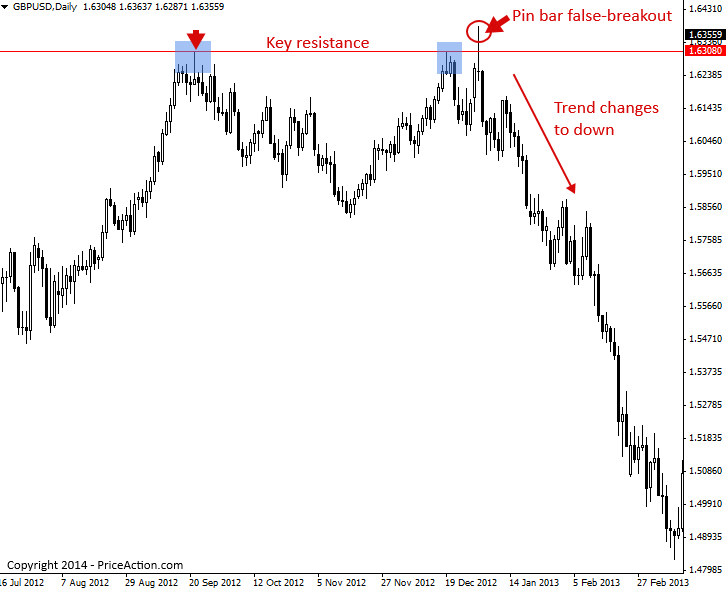

In the chart example below, we can see a key resistance level that held price on two tests, then on the third test, price created a large false-break pin bar strategy that signaled a potential down move was coming.

在下面的图表示例中,我们可以看到一个关键阻力位,该阻力位在两次测试中保持价格,然后在第三次测试中,价格创建了一个大型假突破 pin bar 策略,表明潜在的下跌趋势即将到来。

As we can see in this chart, not only did the false breakout signal a down move, but it kicked off an entire downtrend…

正如我们在这张图表中看到的,虚假突破不仅预示着下跌,而且还拉开了整个下跌趋势的序幕……

False Breakout Pattern Trading Tips

假突破模式交易技巧

- False breakouts occur in trending markets, range-bound markets and against the trend. Watch for them in all market conditions as they often give strong clues as to impending market direction.

假突破发生在趋势市场、区间波动市场和逆势市场。在所有市场条件下密切关注它们,因为它们通常会为即将到来的市场方向提供强有力的线索。 - Trading counter-trend is difficult, but one of the ‘best’ ways to trade against a trend is to wait for a clear false breakout signal against a trend from a key support or resistance levels, as shown in the last example above.

逆势交易很困难,但逆势交易的“最佳”方法之一是等待来自关键支撑位或阻力位的明显虚假突破信号,如上面的最后一个例子所示。 - False-breakouts give us a ‘window’ into the ‘battle’ between amateur and professional traders, hence, they give us a way to trade with the professionals. Learn to identify and trade false breakout patterns and trading will take on a different light for you.

假突破为我们提供了一个了解业余交易者和专业交易者之间“战斗”的“窗口”,因此,它们为我们提供了一种与专业人士进行交易的方式。学会识别和交易虚假的突破模式,交易将为您带来不同的光芒。