The Inside Bar Pattern (Break Out or Reversal Pattern)

内线 K 线形态 (突破或反转形态)

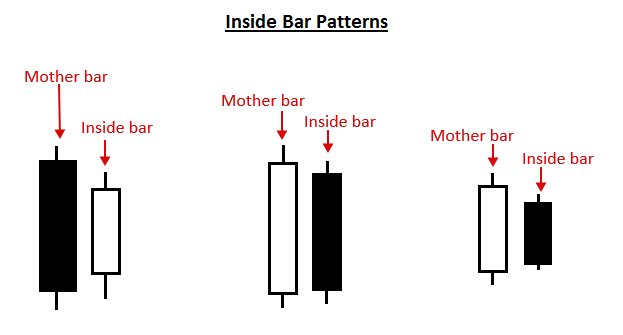

An “inside bar” pattern is a two-bar price action trading strategy in which the inside bar is smaller and within the high to low range of the prior bar, i.e. the high is lower than the previous bar’s high, and the low is higher than the previous bar’s low. Its relative position can be at the top, the middle or the bottom of the prior bar.

“内线”形态是一种两根柱线的价格行为交易策略,其中内线柱线较小,并且在前一根柱线的高到低范围内,即最高价低于前一根柱线的高点,最低价高于前一根柱线的低点。它的相对位置可以在前一根柱的顶部、中间或底部。

The prior bar, the bar before the inside bar, is often referred to as the “mother bar”. You will sometimes see an inside bar referred to as an “ib” and its mother bar referred to as an “mb”.

前一根柱,即内侧柱之前的柱,通常被称为 “mother bar”。您有时会看到一个内线称为 “ib” ,其母线称为 “mb”。

Some traders use a more lenient definition of an inside bar that allows for the highs of the inside bar and the mother bar to be equal, or for the lows of both bars to be equal. However, if you have two bars with the same high and low, it’s generally not considered an inside bar by most traders.

一些交易者对内线柱线使用更宽松的定义,允许内线柱线和母柱线的高点相等,或者两个柱线的最低价相等。但是,如果您有两个最高价和最低价相同的柱线,则大多数交易者通常不会将其视为内线。

Inside bars show a period of consolidation in a market. A daily chart inside bar will look like a ‘triangle’ on a 1 hour or 30 minute chart time frame. They often form following a strong move in a market, as it ‘pauses’ to consolidate before making its next move. However, they can also form at market turning points and act as reversal signals from key support or resistance levels.

内条显示市场盘整期。日线图内的条形图在 1 小时或 30 分钟图表时间范围内看起来像一个“三角形”。它们通常是在市场强劲波动后形成的,因为市场在采取下一步行动之前会“暂停”进行盘整。然而,它们也可以在市场转折点形成,并充当关键支撑位或阻力位的反转信号。

How to Trade with Inside Bars

如何使用 Inside Bars 进行交易

Inside bars can be traded in trending markets in the direction of the trend, when traded this way they are typically referred to as a ‘breakout play’ or an inside bar price action breakout pattern They can also be traded counter-trend, typically from key chart levels, when traded this way they are often referred to as inside bar reversals.

内线柱线可以在趋势市场中沿趋势方向进行交易,当以这种方式交易时,它们通常被称为“突破游戏”或内线柱线价格行为突破模式它们也可以逆势交易,通常从关键图表水平进行交易,当以这种方式交易时,它们通常被称为内线反转。

The classic entry for an inside bar signal is to place a buy stop or sell stop at the high or low of the mother bar, and then when price breakouts above or below the mother bar, your entry order is filled.

内线柱线信号的经典入场是在母柱线的高点或低点设置买入止损或卖出止损,然后当价格突破母柱线上方或下方时,您的挂单被执行。

Stop loss placement is typically at the opposite end of the mother bar, or it can be placed near the mother bar halfway point (50% level), typically if the mother bar is larger than average.

止损设置通常位于母柱的另一端,或者可以放置在母柱的中点附近(50% 水平),通常是如果母柱大于平均值。

It’s worth noting that these are the ‘classic’ or standard entry and stop loss placements for an inside bar setup, in the end, experienced traders may decide on other entries or stop loss placements as they see fit.

值得注意的是,这些是内线设置的“经典”或标准入场和止损设置,最后,经验丰富的交易者可能会决定他们认为合适的其他入场或止损设置。

Let’s take a look at some examples of trading with the inside bar strategy:

让我们看一下使用内线柱策略进行交易的一些示例:

Trading Inside Bars in a Trending Market

在趋势市场中进行柱内交易

In the example below, we can see what it looks like to trade an inside bar pattern in-line with a trending market. In this case, it was a down-trending market, so the inside bar pattern would be called an ‘inside bar sell signal’:

在下面的示例中,我们可以看到与趋势市场一致的内线柱线形态交易是什么样子。在这种情况下,这是一个下降趋势的市场,因此内线柱线形态将被称为 “内线柱线卖出信号”:

Here’s another example of trading an inside bar with a trending market. In this case, the market was trending higher, so the inside bars would be referred to as ‘inside bar buy signals’. Note, often in strong trends like the one in the example below, you will see multiple inside bar patterns forming, providing you with multiple high-probability entries into the trend:

这是另一个在趋势市场中交易内线的例子。在这种情况下,市场呈走高趋势,因此内线柱线将被称为“内线柱线买入信号”。请注意,通常在像下面例子中的强势趋势中,您会看到多个内线柱线形态的形成,为您提供多个高概率的趋势入场:

Trading Inside Bars against the Trend, From Key Chart Levels

逆势在柱内交易,从关键图表水平

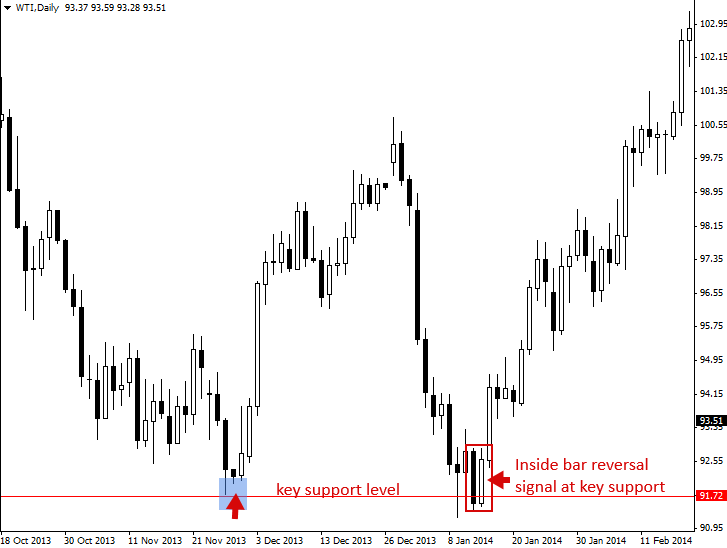

In the example below, we are looking at trading an inside bar pattern against the dominant daily chart trend. In this case, price had come back down to test a key support level , formed a pin bar reversal at that support, followed by an inside bar reversal. Note the strong push higher that unfolded following this inside bar setup.

在下面的示例中,我们正在研究与占主导地位的日线图趋势相反的交易内线柱线形态。在这种情况下,价格回落以测试关键支撑位,在该支撑位形成针柱反转,然后是内柱反转。请注意在这种内线柱设置之后展开的强劲推高。

Here’s another example of trading an inside bar against the recent trend / momentum and from a key chart level. In this case, we were trading an inside bar reversal signal from a key level of resistance. Also, note that the inside bar sell signal in the example below actually had two bars within the same mother bar, this is perfectly fine and is something you will see sometimes on the charts.

这是另一个与近期趋势/动量相反并从关键图表级别交易内线的例子。在这种情况下,我们交易的是来自关键阻力位的内线反转信号。另外,请注意,下面示例中的内线柱线卖出信号实际上在同一个母柱内有两个柱线,这很好,您有时会在图表上看到。

Trading inside bars from key levels of support or resistance can be very lucrative as they often lead to large moves in the opposite direction, as we can see in the chart below…

从关键支撑位或阻力位的柱内交易可能非常有利可图,因为它们通常会导致相反方向的大幅波动,如下图所示……

Tips on Trading the Inside Bar Pattern

交易内线柱线形态的提示

- As a beginning trader, it’s easiest to learn how to trade inside bars in-line with the dominant daily chart trend, or ‘in-line with the trend’. Inside bars at key levels as reversal plays are a bit trickier and take more time and experience to become proficient at.

作为新手交易者,最简单的方法是学习如何在与占主导地位的日线图趋势或“与趋势保持一致”的柱线内进行交易。作为反转游戏,关键级别的内柱有点棘手,需要更多的时间和经验才能精通。 - Inside bars work best on the daily chart time frame, primarily because on lower time frames there are just too many inside bars and many of them are meaningless and lead to false breaks.

内线柱线在日线图时间框架上效果最好,主要是因为在较低的时间框架内线有太多的内线柱线,其中许多毫无意义并导致错误的突破。 - Inside bars can have multiple inside bars within the mother range, sometimes you’ll see 2, 3 or even 4 inside bars within the same mother bar structure, this is fine, it simply shows a longer period of consolidation, which often leads to a stronger breakout. You may see ‘coiling’ inside bars sometimes, these are inside bars with 2 or more inside bars within the same mother bar structure, each inside bar is smaller than the previous and within the high to low range of the previous bar.

内线可以在母线范围内有多个内线,有时您会在同一个母线结构内看到 2、3 甚至 4 个内线,这很好,它只是显示更长的盘整期,这通常会导致更强的突破。有时您可能会在柱内看到“盘绕”,这些是在同一母柱结构内有 2 个或更多内柱的内柱,每个内柱都比前一个小,并且在前一个柱的高到低范围内。 - Practice identifying inside bars on your charts before you try trading them live. Your first inside bar trade should be on the daily chart and in a trending market.

在尝试实时交易之前,先练习识别图表上的内线。您的第一笔内线交易应该在日线图和趋势市场中。 - Inside bars sometimes form following pin bar patterns and they are also part of the fakey pattern (inside bar false-break pattern), so they are an important price action pattern to understand.

内线条形图有时会在针状柱线模式之后形成,它们也是 fakey 模式(内条假突破模式)的一部分,因此它们是需要理解的重要价格行为模式。 - Inside bars typically offer good risk reward ratios because they often provide a tight stop loss placement and lead to a strong breakout as price breaks up or down from the pattern.

内线通常提供良好的风险回报率,因为它们通常提供严格的止损设置,并在价格向上或向下突破该模式时导致强劲突破。