The Pin Bar Pattern (Reversal or Continuation)

Pin Bar 模式 (反转或延续)

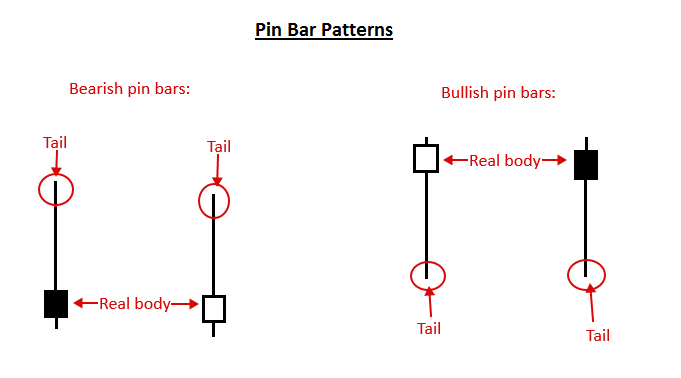

A pin bar pattern consists of one price bar, typically a candlestick price bar, which represents a sharp reversal and rejection of price. The pin bar reversal as it is sometimes called, is defined by a long tail, the tail is also referred to as a “shadow” or “wick”. The area between the open and close of the pin bar is called its “real body”, and pin bars generally have small real bodies in comparison to their long tails.

pin bar 模式由一个价格柱线组成,通常是 K 线价格柱线,它代表价格的急剧反转和拒绝。有时被称为针杆反转,由长尾巴定义,尾巴也称为“阴影”或“灯芯”。针杆的开合区域称为其“真实体”,与它们的长尾相比,针杆通常具有较小的真实体。

The tail of the pin bar shows the area of price that was rejected, and the implication is that price will continue to move opposite to the direction the tail points. Thus, a bearish pin bar signal is one that has a long upper tail, showing rejection of higher prices with the implication that price will fall in the near-term. A bullish pin bar signal has a long lower tail, showing rejection of lower prices with the implication that price will rise in the near-term.

pin bar 的尾部显示被拒绝的价格区域,这意味着价格将继续与尾部指向的方向相反。因此,看跌 pin bar 信号是一个具有长上尾的信号,表明拒绝更高的价格,暗示价格将在短期内下跌。看涨的 pin bar 信号有一个长长的下尾,表明拒绝较低的价格,暗示价格将在短期内上涨。

How to Trade with Pin Bars

如何使用 Pin Bars 进行交易

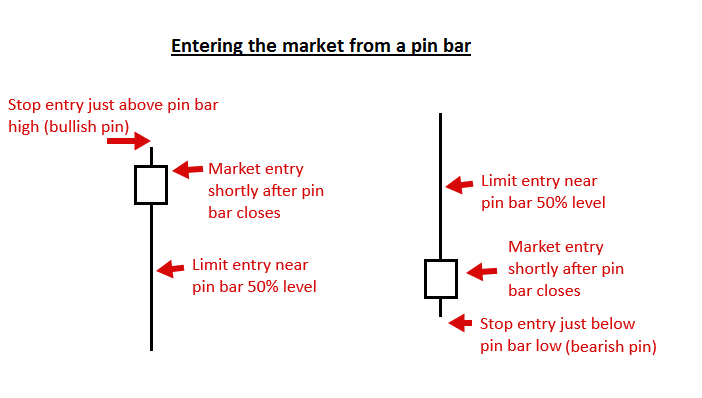

When trading pin bars, there are a few different entry options for traders. The first, and perhaps most popular, is entering the pin bar trade “at market”. That simply means you enter the trade at the current market price.

在交易 pin bar 时,交易者有几种不同的入场选项。第一个,也许也是最受欢迎的,是“在市场上”进入 pin bar 交易。这仅仅意味着您以当前市场价格进行交易。

Note: the pin bar pattern must be closed out before entering the market based on it. Until the bar is closed as a pin bar pattern, it’s not really a pin bar yet.

注意:在根据它进入市场之前,必须将 pin bar 模式平仓。在柱线作为 pin bar 模式关闭之前,它还不是真正的 pin bar。

Another entry option for a pin bar trading signal, is entering on a 50% retrace of the pin bar. In other words, you would wait for price to retrace to about the halfway point of the entire pin bar’s range from high to low, or its “50% level”, where you would have already placed a limit entry order.

pin bar 交易信号的另一个入场选项是在 pin bar 的 50% 回撤处入场。换句话说,您将等待价格回撤到整个 pin bar 范围从高到低的中点左右,或其“50% 水平”,您已经在该水平下达了限价挂单。

A trader can also enter a pin bar signal by using an “on-stop” entry, placed just below the low or above the high of the pin bar.

交易者还可以使用 “on-stop” 入场来输入针柱信号,该输入位于针柱的低点下方或高于 pin bar 的高点。

Here’s an example of what the various pin bar entry options might look like:

以下是各种 pin bar entry 选项的示例:

Trading Pin Bar Signals in a Trending Market

在趋势市场中交易 Pin Bar 信号

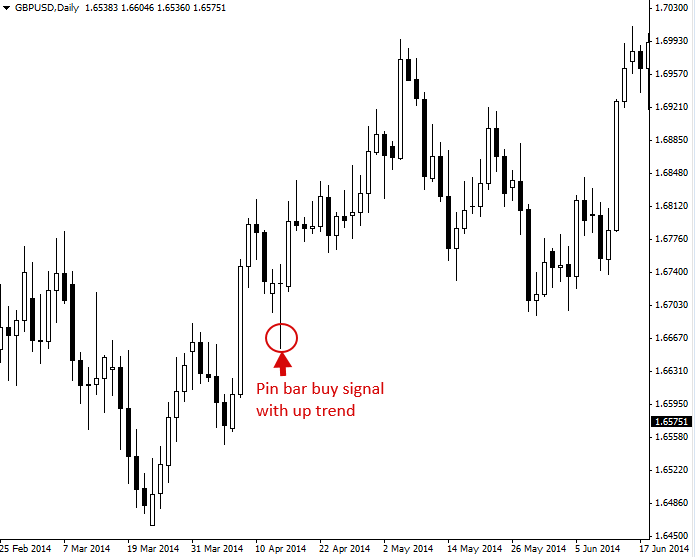

Trading with the trend is arguably the best way to trade any market. A pin bar entry signal, in a trending market, can offer a very high-probability entry and a good risk to reward scenario.

顺势交易可以说是交易任何市场的最佳方式。在趋势市场中,pin bar 入场信号可以提供非常高的入场概率和良好的风险回报情景。

In the example below, we can see a bullish pin bar signal that formed in the context of an up-trending market. This type of pin bar shows rejection of lower prices (note the long lower tail), so it’s called a “bullish pin bar” since the implication of the rejection reflected in the pin bar is that the bulls will resume pushing price higher…

在下面的示例中,我们可以看到在上升趋势市场背景下形成的看涨 pin bar 信号。这种类型的 pin bar 表示拒绝较低的价格(注意长长的低尾),因此它被称为“看涨 pin bar”,因为 pin bar 中反映的拒绝意味着多头将继续推高价格……

Trading Pin Bars against the Trend, From Key Chart Levels

从关键图表水平逆势交易 Pin Bars

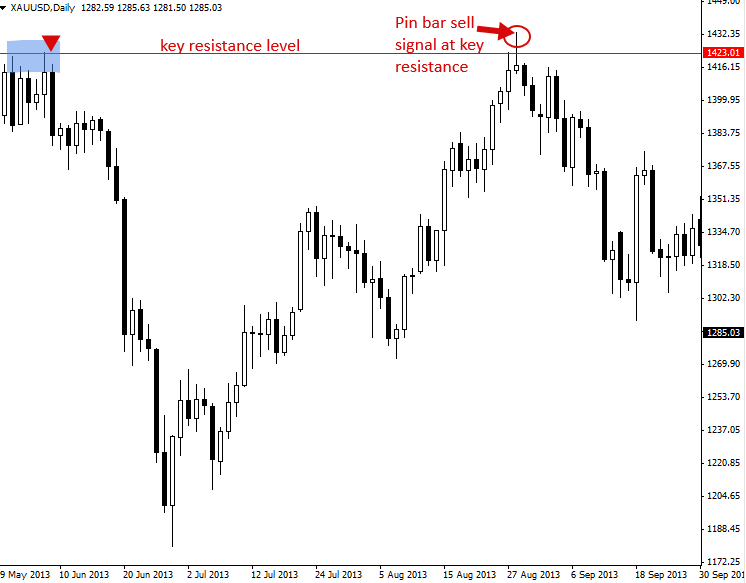

When trading a pin bar counter to, or against a dominant trend, it’s widely accepted that a trader should do so from a key chart level of support or resistance. The key level adds extra ‘weight’ to the pin bar pattern, just as it does with counter-trend inside bar patterns. Any time you see a point in the market where price initiated a significant move either up or down, that is a key level to watch for pin bar reversals.

当交易 pin bar 逆主流趋势或逆主流趋势时,人们普遍认为交易者应该从关键图表的支撑或阻力位进行交易。关键级别为 pin bar 模式增加了额外的 “权重”,就像它与逆势的内线 bar 模式一样。任何时候您在市场中看到价格开始大幅上涨或下跌的某个点,这就是观察 pin bar 反转的关键水平。

Pin bar Combo Patterns Pin bar 组合模式

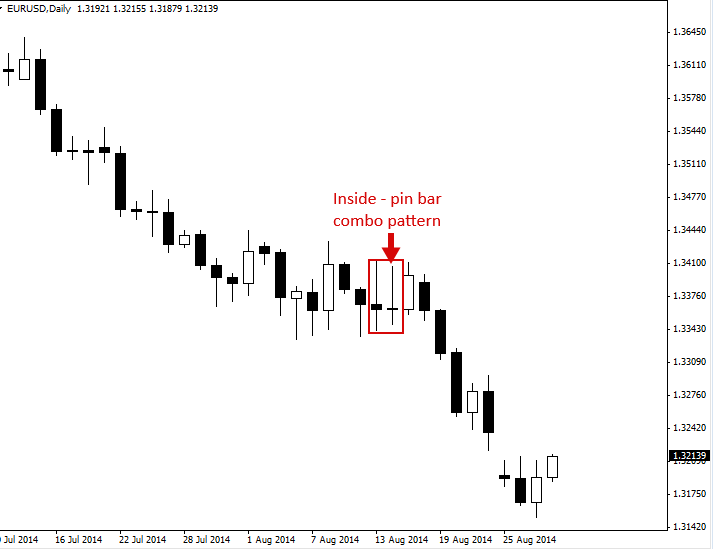

Pin bars can also be traded in combination with other price action patterns. In the chart below, we can see an inside pin bar combo pattern. This is a pattern in which the inside bar is also a pin bar pattern. These inside pin bar signals work best in trending markets like we see below…

Pin bars 也可以与其他价格行为模式一起交易。在下图中,我们可以看到一个内针柱组合模式。在这种模式中,内线也是 pin bar 模式。这些内线 pin bar 信号在趋势市场中效果最佳,如下所示……

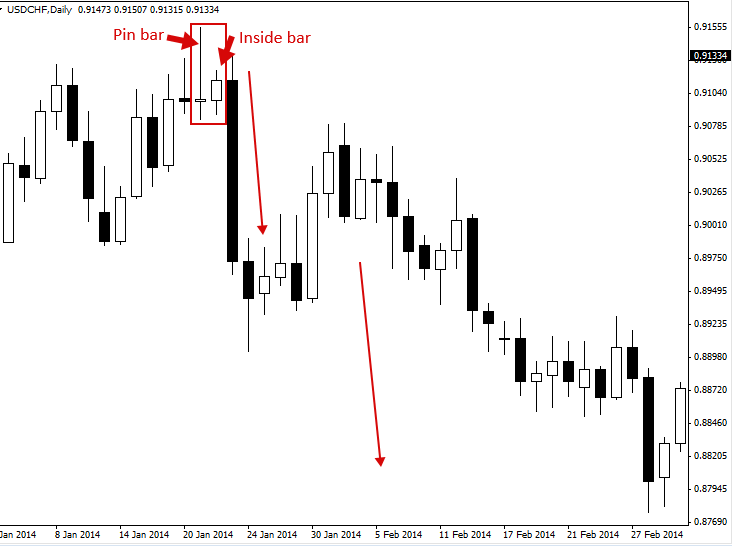

The pattern in the chart below could be considered the ‘opposite’ of the inside-pin bar, it’s an inside bar inside a pin bar signal. It’s relatively common to see an inside bar form within the range of a pin bar pattern. Often, a large breakout move will follow an inside bar formed within a pin bar’s range, for this reason, the pin bar + inside bar combo setup is a very potent price action trading pattern, as we can see in the chart below…

下图中的模式可以被认为是内针柱的 “相反”,它是针柱信号内的内线。在 pin bar 模式范围内看到内条形是相对常见的。通常,在针杆范围内形成的内线之后会有一个大的突破走势,因此,针杆 + 内线柱组合设置是一种非常有效的价格行为交易模式,如下图所示……

Double Pin Bar Patterns 双销杆模式

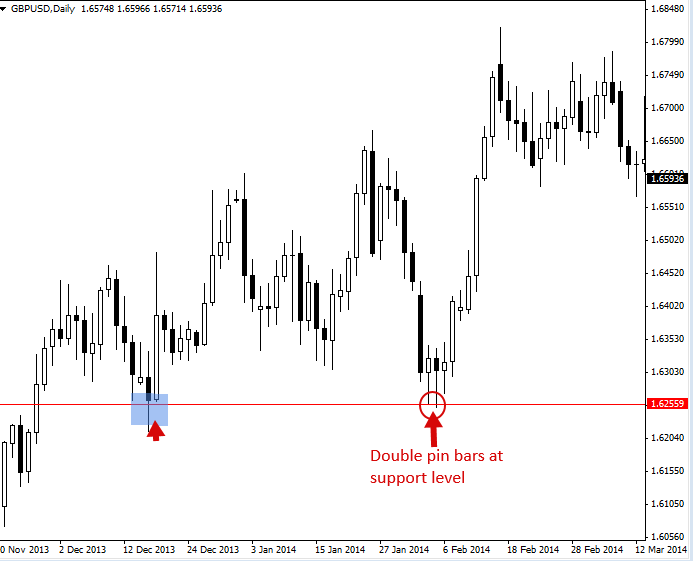

It is not uncommon to see back-to-back or “double pin bar patterns” from at key levels in the market. These patterns are traded just like a normal pin bar, except they provide a trader with a little more ‘confirmation’ since they reflect two consecutive rejections of a level…

从市场的关键水平看到背靠背或“双针柱线模式”的情况并不少见。这些模式的交易方式就像普通的 pin bar 一样,不同之处在于它们为交易者提供了更多的“确认”,因为它们反映了对某个水平的连续两次拒绝……

Pin Bar Trading Tips Pin Bar 交易技巧

- As a beginning trader, it’s easiest to learn how to trade pin bars in-line with the dominant daily chart trend, or ‘in-line with the trend’. Counter-trend pin bars are a bit trickier and take more time and experience to become proficient at.

作为新手交易者,最简单的方法是学习如何根据占主导地位的日线图趋势或“与趋势一致”交易 pin K线。逆势 pin bar 有点棘手,需要更多的时间和经验才能精通。 - Pin bars basically show a reversal in the market, so they are a very good tool for predicting the near-term, and sometimes long-term, direction of price. They often mark major tops or bottoms (turning points) in a market.

针状柱线基本上显示市场的反转,因此它们是预测近期(有时是长期)价格方向的非常好的工具。它们通常标志着市场的主要顶部或底部(转折点)。 - Not every pin bar is going to be one worth trading. The best ones occur in strong trends after a retrace to support or resistance within the trend, or from a key chart level of support or resistance.

并非每个 pin bar 都值得交易。最好的出现在回撤到趋势内的支撑或阻力位之后的强劲趋势中,或者从关键图表的支撑位或阻力位开始。 - As a beginner, keep your eyes peeled for daily chart time frame pin bars as well as 4 hour chart time frame pin bars, as they seem to be the most accurate and profitable.

作为初学者,请密切关注日线图时间框架 pin bar 和 4 小时图表时间框架 pin bars,因为它们似乎是最准确和最有利可图的。 - Longer tails on a pin bar indicate a more significant reversal and rejection of price. Thus, long-tailed pin bars tend to be a little higher-probability than their shorter-tailed counter-parts. Long-tailed pin bars also tend to see price retrace to near the pin bar’s 50% level more often than shorter-tailed pins, this means they are typically better candidates for the 50% retrace entry discussed previously.

pin bar 上较长的尾部表示价格的更显着反转和拒绝。因此,长尾针杆的概率往往比短尾针杆高一点。与短尾针式相比,长尾 pin 柱线的价格也往往更频繁地回撤至 pin 柱线的 50% 水平附近,这意味着它们通常更适合前面讨论的 50% 回撤位入场。 - Pin bars will show up in any market. Be sure you practice identifying and trading them on a demo account before trading them with real money. Practice makes perfect.

Pin bars 将出现在任何市场。在用真钱交易它们之前,请务必在模拟账户上练习识别和交易它们。熟能生巧。