What is support and resistance?

什么是支撑位和阻力位?

Support and resistance levels are horizontal price levels that typically connect price bar highs to other price bar highs or lows to lows, forming horizontal levels on a price chart.

支撑位和阻力位是水平价格水平,通常将价格条高点与其他价格条高点或低点与低点连接起来,在价格图表上形成水平水平。

A support or resistance level is formed when a market’s price action reverses and changes direction, leaving behind a peak or trough (swing point) in the market. Support and resistance levels can carve out trading ranges like we see in the chart below and they also can be seen in trending markets as a market retraces and leaves behind swing points.

当市场的价格行为反转并改变方向,在市场上留下峰值或低谷(波动点)时,就会形成支撑位或阻力位 。支撑位和阻力位可以划定交易区间,如下图所示,它们也可以在趋势市场中看到,因为市场回撤并留下摆动点。

Price will often respect these support and resistance levels, in other words, they tend to contain price movement, until of course price breaks through them.

价格通常会尊重这些支撑位和阻力位,换句话说,它们往往会遏制价格波动,直到价格当然突破它们。

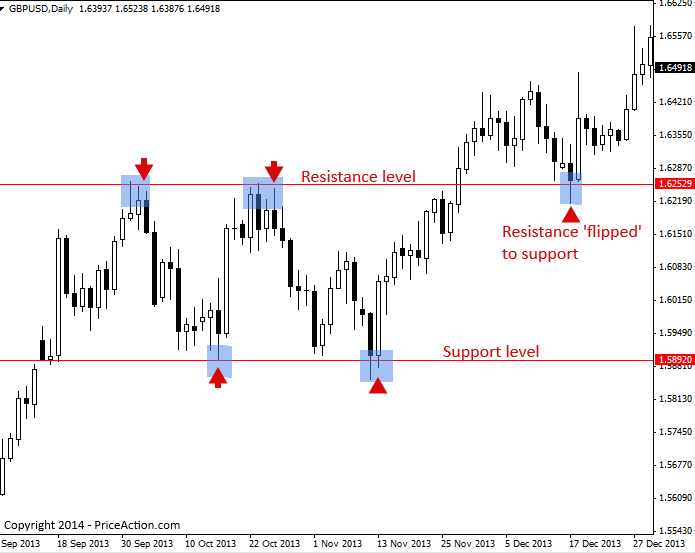

In the chart below, we see an example of support and resistance levels containing price within a trading range. A trading range is simply an area of price contained between parallel support and resistance levels like we see below (price oscillates between the support and resistance levels in a trading range).

在下图中,我们看到一个支撑位和阻力位的示例,其中包含交易区间内的价格。交易区间只是包含在平行支撑位和阻力位之间的一个价格区域,如下所示(价格在交易区间内的支撑位和阻力位之间波动)。

Note that in the chart below, price eventually broke up and out of the trading range, moving above the resistance level, then when it came back down and tested the old resistance level, it then held price and acted as support…

请注意,在下图中,价格最终跌破并走出交易区间,移动到阻力位上方,然后当它回落并测试旧的阻力位时,它随后守住价格并充当支撑位……

The other primary way support and resistance levels are created in a market, is from swing points in a trend.

在市场上创建支撑位和阻力位的另一种主要方式是从趋势中的摆动点开始。

As a market trends, it retraces back on the trend and this retracement leaves a ‘swing point’ in the market, which in an uptrend looks like a peak and a downtrend looks like a trough.

随着市场趋势,它会沿着趋势回撤,这种回撤在市场上留下一个“摆动点”,在上升趋势中看起来像一个峰值,而下降趋势看起来像一个低谷。

In an uptrend, the old peaks will tend to act as support after price breaks up past them and then retraces back down to test them. In a downtrend, the opposite is true; the old troughs will tend to act as resistance after price breaks down through them and then retraces back up to test them.

在上升趋势中,旧峰值在价格突破后往往会充当支撑,然后回撤以测试它们。在下降趋势中,情况恰恰相反;旧低谷在价格跌破后往往会充当阻力位,然后回撤以测试它们。

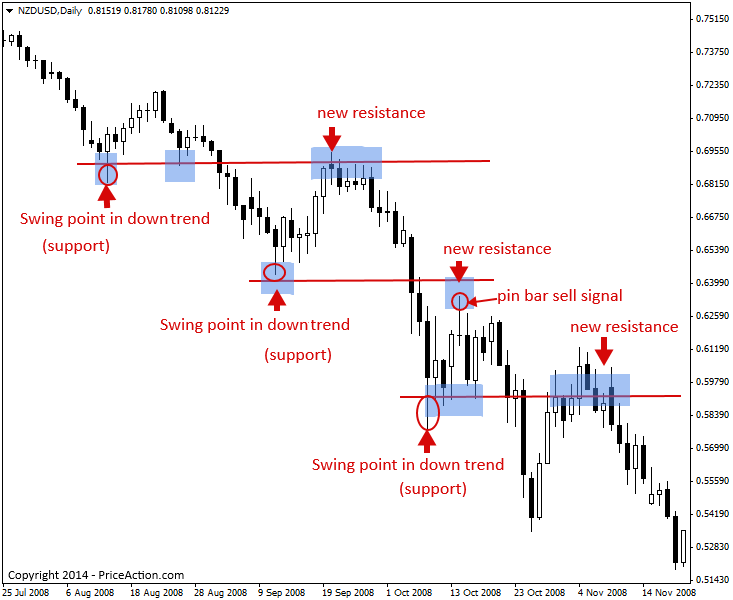

Here’s an example of a market testing previous swing points (support) in a downtrend, note that as the market comes back to test the old support, the level then behaves as ‘new’ resistance and will very often hold price. It’s wise to look for an entry point into a trend as it comes back and tests these previous swing points (see pin bar sell signal in chart below), because it’s at these levels that the trend is most likely to resume, creating a low-risk / high-reward potential:

这是一个市场在下降趋势中测试先前摆动点(支撑位)的示例,请注意,当市场回来测试旧支撑位时,该水平表现为“新”阻力位,并且通常会保持价格。明智的做法是在趋势回归时寻找进入趋势的切入点并测试之前的摆动点(参见下图中的柱线卖出信号),因为正是在这些水平上,趋势最有可能恢复,从而产生低风险/高回报的潜力:

How to trade price action signals from support and resistance levels

如何从支撑位和阻力位交易价格行动信号

Support and resistance levels are a price action trader’s ‘best friend’. When a price action entry signal forms at a key level of support or resistance, it can be a high-probability entry scenario. The key level gives you a ‘barrier’ to place your stop loss beyond and since it has a strong chance of being a turning point in the market, there’s usually a good risk reward ratio formed at key levels of support and resistance in a market.

支撑位和阻力位是价格行为交易者的“最好的朋友”。当价格行为入场信号在支撑位或阻力位的关键水平形成时,这可能是一个高概率的入场场景。关键水平为您提供了一个“障碍”,可以设置您的止损,并且由于它很有可能成为市场的转折点,因此通常在市场的支撑和阻力关键水平上形成良好的风险回报率。

The price action entry signal, such as a pin bar signal or other, provides us with some ‘confirmation’ that price may indeed move away from the key level of support or resistance.

价格行为入场信号,例如针杆信号或其他信号,为我们提供了一些“确认”,即价格确实可能远离关键支撑位或阻力位。

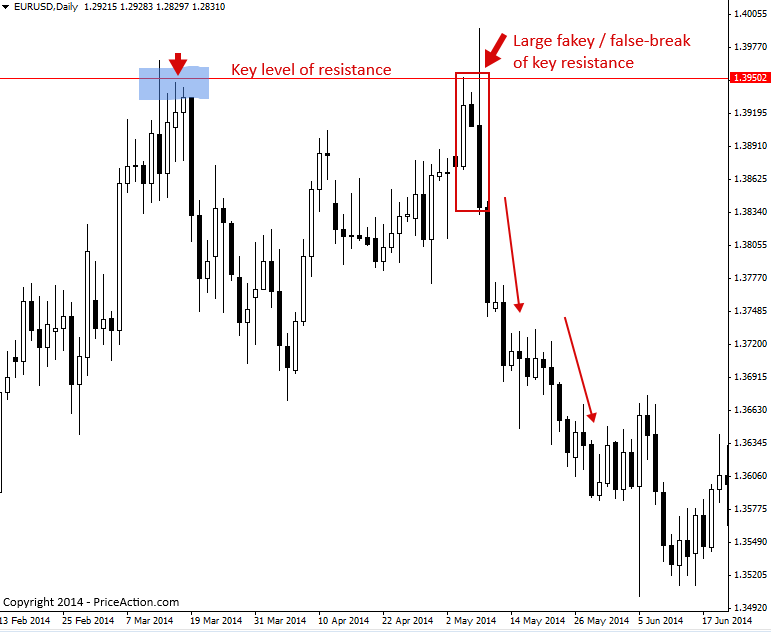

In the example chart below, we see a key level of resistance and a bearish fakey strategy that formed at it. Since this fakey showed such aggressive reversal and a false-break of the key resistance, there was a high-probability that price would continue lower following the signal…

在下面的示例图表中,我们看到了一个关键的阻力位和一个在其上形成的看跌 fakey 策略。由于这个骗局显示了如此激进的反转和关键阻力位的假突破,因此价格很有可能在信号发出后继续走低……

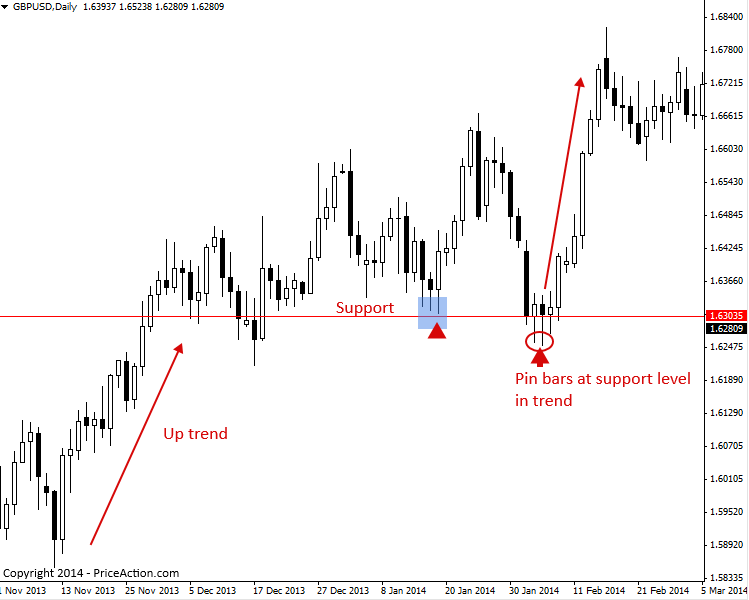

The next example chart shows us how to trade price action from a support level in an uptrend. Note that once we got a clear pin bar buy signal, actually two pin bar signals in this case, the uptrend was ready to resume and pushed significantly higher from the key support level.

下一个示例图表向我们展示了如何在上升趋势中从支撑位交易价格走势。请注意,一旦我们获得明确的 pin bar 买入信号,在本例中实际上是两个 pin bar 信号,上升趋势就准备好恢复并从关键支撑位显着推高。

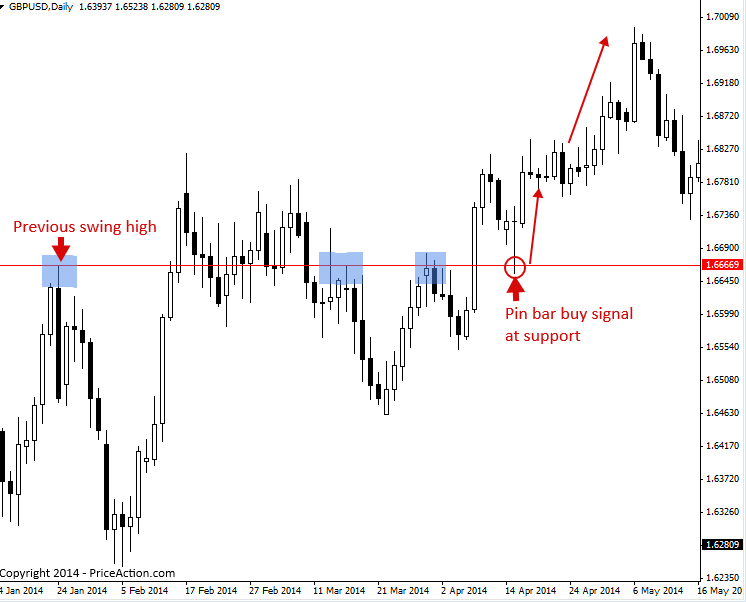

The next chart example show us how sometimes in trending markets a previous swing level will act as a new support or resistance level and provide a good level to focus our attention on for price action entry signals.

下一个图表示例向我们展示了在趋势市场中,前一个摆动水平有时如何充当新的支撑位或阻力位,并为我们将注意力集中在价格行为入场信号上的良好水平。

In this case, the trend was up and a previous swing high in the uptrend eventually ‘flipped’ into a support level after price broke up above it. We can see that when price came back to retest that level the second time, it formed a nice pin bar entry signal to buy the market and re-enter the uptrend from a confluent level in the market.

在这种情况下,趋势是上升的,并且在价格跌破后,上升趋势中的先前摆动高点最终“翻转”为支撑位。我们可以看到,当价格第二次返回重新测试该水平时,它形成了一个很好的 pin bar 入场信号,买入市场并从市场的汇合水平重新进入上升趋势。

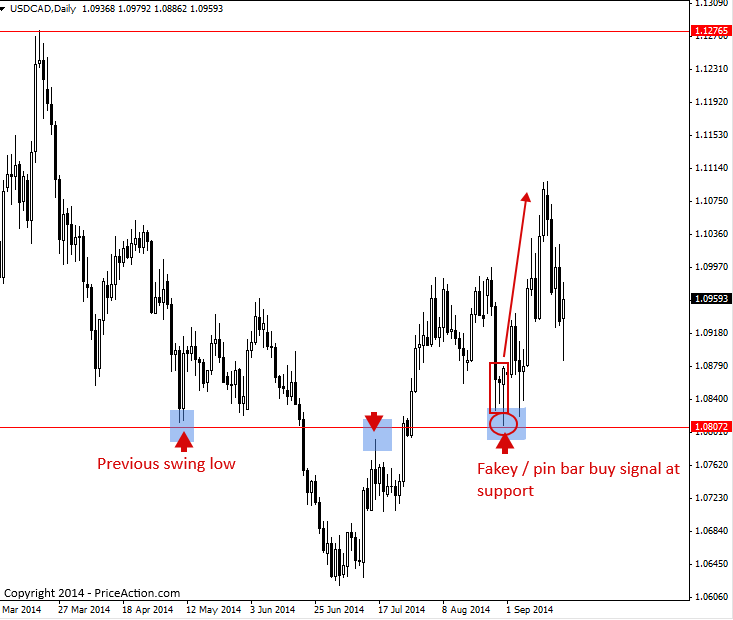

Finally, the last chart we are looking at is an interesting one. Note the swing low that occurred in the down trend on the left side of the chart. You can see how this level stayed relevant months later, even after the trend changed from down to up. It first acted as a resistance level after price broke down through it, but once that resistance was broken, we had an uptrend form and then after that, that same level acted as support, and that’s where we see the fakey pin bar combo signal in the chart below:

最后,我们正在查看的最后一张图表是一个有趣的图表。请注意图表左侧下降趋势中出现的摆动低点。您可以看到该水平在几个月后如何保持相关性,即使在趋势从下降变为上升之后也是如此。在价格跌破后,它首先充当阻力位,但一旦突破阻力位,我们就会形成上升趋势,然后,同一水平充当支撑位,这就是我们在下图中看到 fakey pin bar 组合信号的地方:

Tips on Support and Resistance

关于支撑位和阻力位的提示

- Don’t get too carried away with trying to draw every little level on your charts. Aim to find the key daily chart levels, like we showed in the examples above, as these are the most important ones.

不要太得意忘形地尝试在图表上绘制每一个小级别。旨在找到关键的日线图水平,就像我们在上面的例子中展示的那样,因为这些是最重要的水平。 - The horizontal lines of support or resistance that you draw won’t always touch the ‘exact’ high or low of the bars it connects. Sometimes, it’s OK if the line connects bars slightly down from the high or up from the low. The important thing to realize is that this is not an exact science, instead it is both a skill and an art that you’ll improve at through training, experience and time.

您绘制的支撑或阻力水平线并不总是触及它所连接的柱线的“确切”高点或低点。有时,如果这条线连接的条形从高点略微向下或从低点略微向上,那也是可以的。重要的是要意识到,这不是一门精确的科学,它既是一种技能,也是一门艺术,您将通过培训、经验和时间来提高。 - When in doubt about whether to take a particular price action entry signal or not, ask yourself if it’s at a key level of support or resistance. If it’s not at a key level of support or resistance, it might be better to pass on the signal.

当不确定是否采取特定的价格行为入场信号时,问问自己它是否处于关键支撑位或阻力位。如果它不在关键支撑位或阻力位,最好传递信号。 - A price trading strategy, such as a pin bar, fakey, or inside bar strategy has a significantly better chance of working out if it forms from a confluent level of support or resistance in a market.

价格交易策略,例如 pin bar、fakey 或 inside bar 策略,如果它从市场的支撑或阻力汇合水平形成,则成功的机会要大得多。