What is a Japanese candlestick pattern?

什么是日本蜡烛图形态?

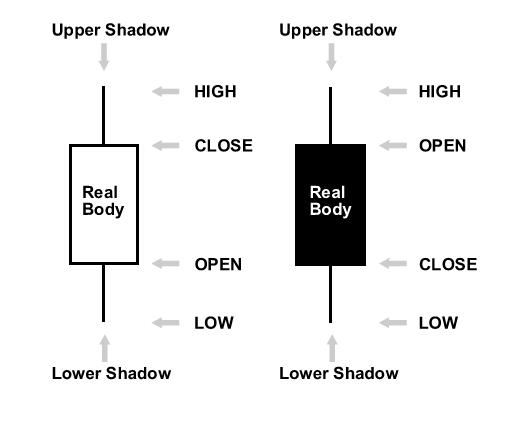

A candlestick shows the open, high, low and close of the market for a particular period of time. If you’re looking at a daily chart time frame for example, each candlestick will reflect the open, high, low and close for that days’ worth of price action.

蜡烛显示特定时间段内市场的开盘价、最高价、最低价和收盘价。例如,如果您正在查看日线图时间框架,则每根烛台都将反映当天价格走势的开盘价、最高价、最低价和收盘价。

The primary difference between a candlestick and a standard price bar, is that candlesticks display a colored portion between the open and close of the candle. This allows traders to quickly see if price closed higher (bullish) or lower (bearish) on the day, which is important piece of information for any price action trader.

烛台和标准价格条之间的主要区别在于,烛台在蜡烛的开盘价和收盘价之间显示一个彩色部分。这使交易者能够快速查看当天价格收盘价是更高(看涨)还是更低(看跌),这对任何价格行为交易者来说都是重要的信息。

Let’s take a look at a picture of a bullish and bearish candlestick to see this more clearly…

我们来看一下看涨和看跌 K 线的图片,以便更清楚地看到这一点……

Note: the candlestick on the left is a ‘bullish candle’ because its close is higher than its open. The candle on the right is a ‘bearish candle’ because its close is lower than its open….

注意:左侧的烛台是“看涨蜡烛”,因为它的收盘价高于开盘价。右边的蜡烛是“看跌蜡烛”,因为它的收盘价低于开盘价。

The colored section of the candlestick is called the “real body” or body. Note: The color of the real body can vary between traders and depends on how they have the colors set / personal preference. The standard color scheme for the real body is white for bullish and black for bearish and is in our opinion, the cleanest and best option.

蜡烛图的彩色部分称为 “real body” 或 body。注意:真实身体的颜色可能因交易者而异,具体取决于他们如何设置颜色/个人喜好。真实实体的标准配色方案是白色代表看涨,黑色代表看跌,在我们看来,这是最干净和最好的选择。

The thin lines poking above and below the body display the high/low range and are called shadows, tails or wicks…all three names apply to the same thing. The top of the upper shadow is the “high”. The bottom of the lower shadow is the “low”.

身体上方和下方戳出的细线显示高/低范围,称为阴影、尾巴或灯芯……所有三个名称都适用于同一事物。上影线的顶部是 “high”。下影线的底部是 “low”。

What is a candlestick pattern?

什么是烛台形态?

A candlestick pattern is a one or sometimes multi-bar price action pattern shown graphically on a candlestick chart that price action traders use to predict market movement. The recognition of the patter is somewhat subjective, as such it requires training by an experienced / professional price action trader as well as one’s own experience via screen time, to develop skill in identifying and trading candlestick patterns.

K 线形态是 K 线图上以图形方式显示的单根或有时多根柱线的价格行为形态,交易者用它来预测市场走势。对模式的识别在某种程度上是主观的,因此它需要由经验丰富/专业的价格行为交易员进行培训,并通过屏幕时间获得自己的经验,以培养识别和交易烛台模式的技能。

There are numerous different candlestick patterns, and many are just slight variations on the same basic principle. Therefore, at priceaction.com, we feel it makes more sense to focus in on a smaller ‘handful’ of proven candlestick patterns that give a trader a solid toolbox of trade signals to work with, rather than trying to learn 30 different patterns, many of which are essentially the same thing.

有许多不同的 K 线形态,其中许多只是同一基本原理的细微变化。因此,在 priceaction.com,我们认为专注于一小部分经过验证的 K 线形态更有意义,这些形态为交易者提供了一个可靠的交易信号工具箱,而不是试图学习 30 种不同的形态,其中许多形态本质上是一回事。

Here are some of our favorite price action trading candlestick strategies:

以下是我们最喜欢的一些价格行为交易 K 线策略:

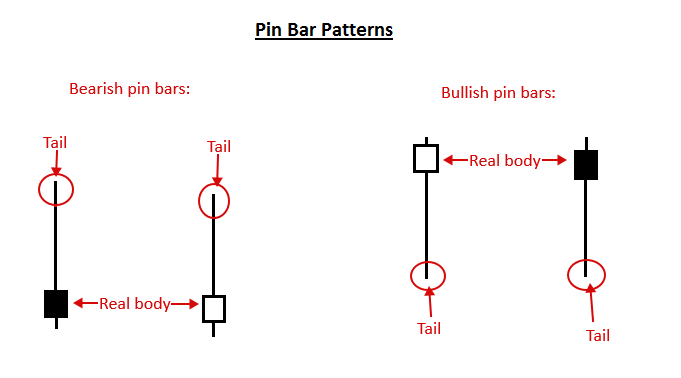

Pin bar candlestick pattern – A pin bar candlestick pattern is a one bar pattern that shows rejection of a price level or area. The pattern has a small real body and a long shadow or ‘tail’ on only one side, indicating rejection of that price area. Pin bars can be traded as reversal signals either within a trend or against a trend. Here’s what a pin bar looks like:

Pin bar candlestick pattern – pin bar candlestick 模式是一种单条模式,显示对价格水平或区域的拒绝。该模式有一个小的真实实体和仅在一侧的长影线或 “尾巴”,表明拒绝该价格区域。pin bar 可以作为趋势内或逆势的反转信号进行交易。下面是 pin bar 的样子:

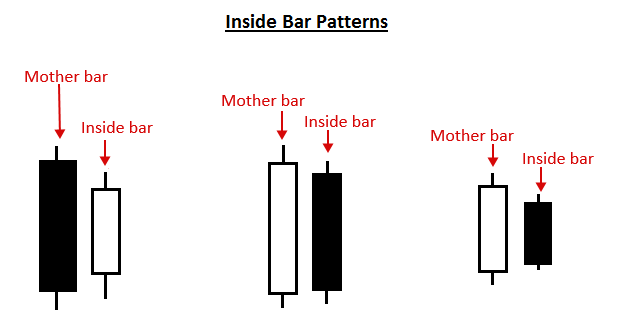

Inside bar candlestick pattern – An inside bar candlestick pattern is at least a two bar pattern (can have multiple inside bars) that shows indecision or stalling in a market. An inside bar trading strategy typically works best in a trending market as a price action breakout strategy but can also be used as a reversal strategy sometimes from key chart levels. Here’s an example of inside bars:

内条形 K 线形态 – 内线 K 线形态至少是一个两根柱线形态(可以有多个内线),表明市场犹豫不决或停滞不前。内线交易策略通常作为价格行为突破策略在趋势市场中效果最佳,但有时也可以用作关键图表水平的反转策略。下面是一个内线示例:

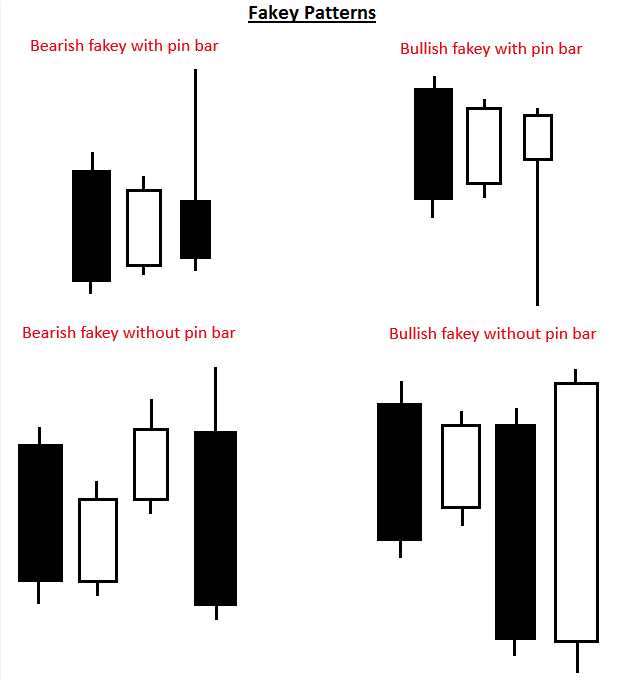

Fakey candlestick pattern – A fakey candlestick pattern is typically a three or four bar pattern that shows a false break of an inside bar pattern. The fakey pattern shows a ‘fake out’ has occurred in the market and the price is likely to then continue in the direction opposite the false break. Below, we see an example of what the fakey pattern looks like:

Fakey candlestick pattern – Fakey 烛台模式通常是三柱或四柱模式,显示内部柱线模式的假突破。虚假模式显示市场上发生了“假出局”,然后价格可能会继续朝着与虚假突破相反的方向发展。下面,我们看到 fakey 模式的示例:

What is a candlestick chart?

什么是K线图?

A candlestick chart is a price chart that is populated by candlesticks, instead of standard price bars as in a bar chart or lines, as in a line chart.

蜡烛图是由蜡烛图填充的价格图表,而不是条形图中的标准价格条或折线图中的折线图。

Each candlestick shows the high, low, open and close for the period of time it reflects, this is the same information reflected in traditional price bars, but candlesticks make this information much easier to visualize and make use of.

每根烛台都显示其反映的时间段内的最高价、最低价、开盘价和收盘价,这与传统价格条中反映的信息相同,但烛台使这些信息更容易可视化和使用。

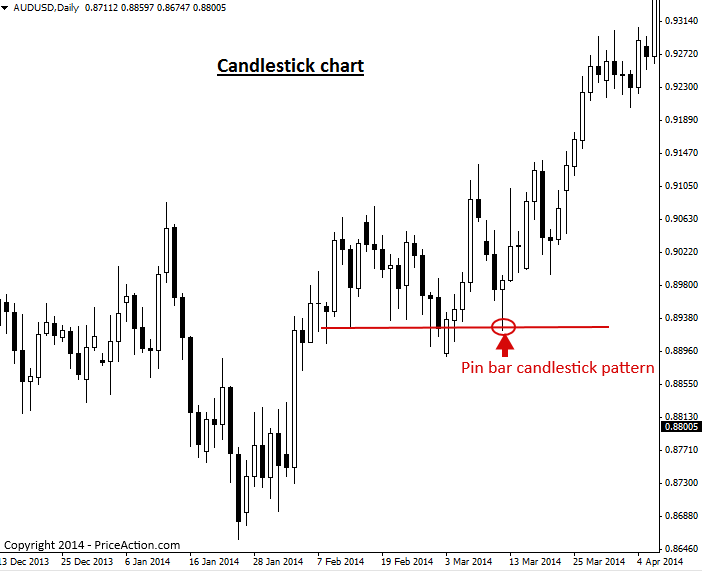

Here’s an example of a typical candlestick chart. Note the pin bar candlestick pattern that formed from support on this chart, and the large up move that followed…

这是一个典型的 K 线图示例。请注意此图表上从支撑位形成的 pin bar 烛台形态,以及随后的大幅上涨走势……

Advantage of candlestick charts

K 线图的优势

The primary advantage of a candlestick price action chart is that it provides a more impactful or perhaps ‘dramatic’ visual display of price movement over time, than what you will see on a standard bar chart or line chart. Due to the fact that each candle’s real body is colored in according to its close being bullish or bearish, the dynamics between price bars is significantly easier to read, and many traders would argue more ‘fun’ as well.

K 线价格走势图的主要优点是,它比您在标准条形图或折线图上看到的价格走势更具影响力或“戏剧性”的视觉显示。由于每根蜡烛的真实实体都根据其收盘价看涨或看跌而着色,因此价格条之间的动态明显更容易阅读,许多交易者也会认为更“有趣”。

Ultimately, whether a trader uses a standard bar chart or a candlestick chart is a matter of personal preference and opinion. But, it is my opinion, and the opinion of most successful price action traders, that one should use candlestick charts to get a better view and feel for market sentiment and to more easily spot price action trading signals.

归根结底,交易者是使用标准条形图还是烛台图是个人喜好和意见的问题。但是,我的观点,以及大多数成功的价格行为交易者的观点,应该使用K线图来更好地观察和感受市场情绪,并更容易发现价格行为交易信号。

😁😊😊😊